Why Derivatives?

Take the benefits of equity one step further

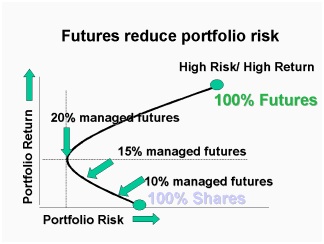

Derivatives do away with the need to invest a large amount of capital upfront and allowing you to benefit from market movements. This gives you greater liquidity than most other assets. They are an excellent avenue to help you leverage on anticipated market movements and an effective tool to hedge your risks, speculate and earn returns in a relatively shorter duration. You can trade in Futures - contracts or an agreement between two parties to either buy or sell a fixed quantity of assets at a particular time in the future for a fixed price OR Options - A similar contract, except the parties are not obligated to fulfill the terms of the agreement. These contracts are then traded in the market.

Enables you to get higher trading exposure with a low margin amount

Allows you to safeguard yourself against potential losses, by hedging your positions. As a part of this, you buy in the cash segment and agree to sell in the derivatives market or vice versa.

Allows you to choose between conservative or high risk strategies based on the expected rise and fall of stock prices

Possibility to garner returns irrespective of market moving up, down or sideways

RNL INVESTMENT PARTNERS

Ground Floor, Plot No 53,Sanjvat Apartment,

Opposite Traffic Park,

Khare Town,Nagpur - 440010

+91 9921858520

RNL Investment Partners © 2019-20

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-120120 | Date of initial registration – 07-Feb-2017 | Current validity of ARN – 06-Feb-2026

Grievance Officer- Pratik Mukasdar| pratik@rnlip.com

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors