Why Equities?

Long-term wealth creation

Investing in equities for a long term has many advantages. Here is why equity investments have an edge over simply saving money in your bank account:

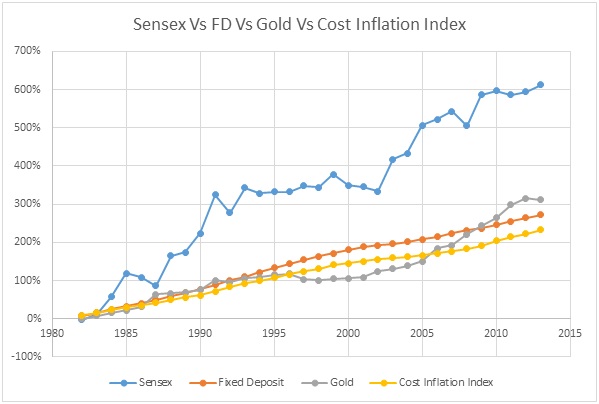

Inflation drives up the cost of living and eats away the value of your savings. Traditional investment avenues like Fixed Deposits, Bonds, etc. have a limited upside of 8 to 10 %, whereas equities as an asset class have given an average annual return of about 13 % in the last 10 years. Hence, when it comes to beating inflation, equities are undoubtedly your best bet

Our philosophy of "Buy Right Sit Tight " has helped a lot of investors in long term wealth creation. Investing in good businesses and growth stories at an early stage provides unlimited upside potential. For example, your investment of Rs. 1,000 in the Infosys IPO in 1993, would have fetched you Rs. 30 Lakhs today. Not participating in growth stories would certainly be an opportunity missed

Equities also provide you the flexibility of quickly changing your holding patterns to suit your requirements and also convert your holdings into cash instantly. This makes it the most suitable option compared to other asset classes for investors who are looking for liquidity

RNL INVESTMENT PARTNERS

Ground Floor, Plot No 53,Sanjvat Apartment,

Opposite Traffic Park,

Khare Town,Nagpur - 440010

+91 9921858520

RNL Investment Partners © 2019-20

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-120120 | Date of initial registration – 07-Feb-2017 | Current validity of ARN – 06-Feb-2026

Grievance Officer- Pratik Mukasdar| pratik@rnlip.com

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors